Business Insurance in and around Centralia

Centralia! Look no further for small business insurance.

This small business insurance is not risky

Insure The Business You've Built.

It takes courage to start your own business, and it also takes courage to admit when you might need support. State Farm is here to help with your business insurance needs. With options like extra liability coverage, errors and omissions liability and worker's compensation for your employees, you can rest assured that your small business is properly protected.

Centralia! Look no further for small business insurance.

This small business insurance is not risky

Strictly Business With State Farm

Whether you own a photography business, a HVAC company or a bakery, State Farm is here to help. Aside from fantastic service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

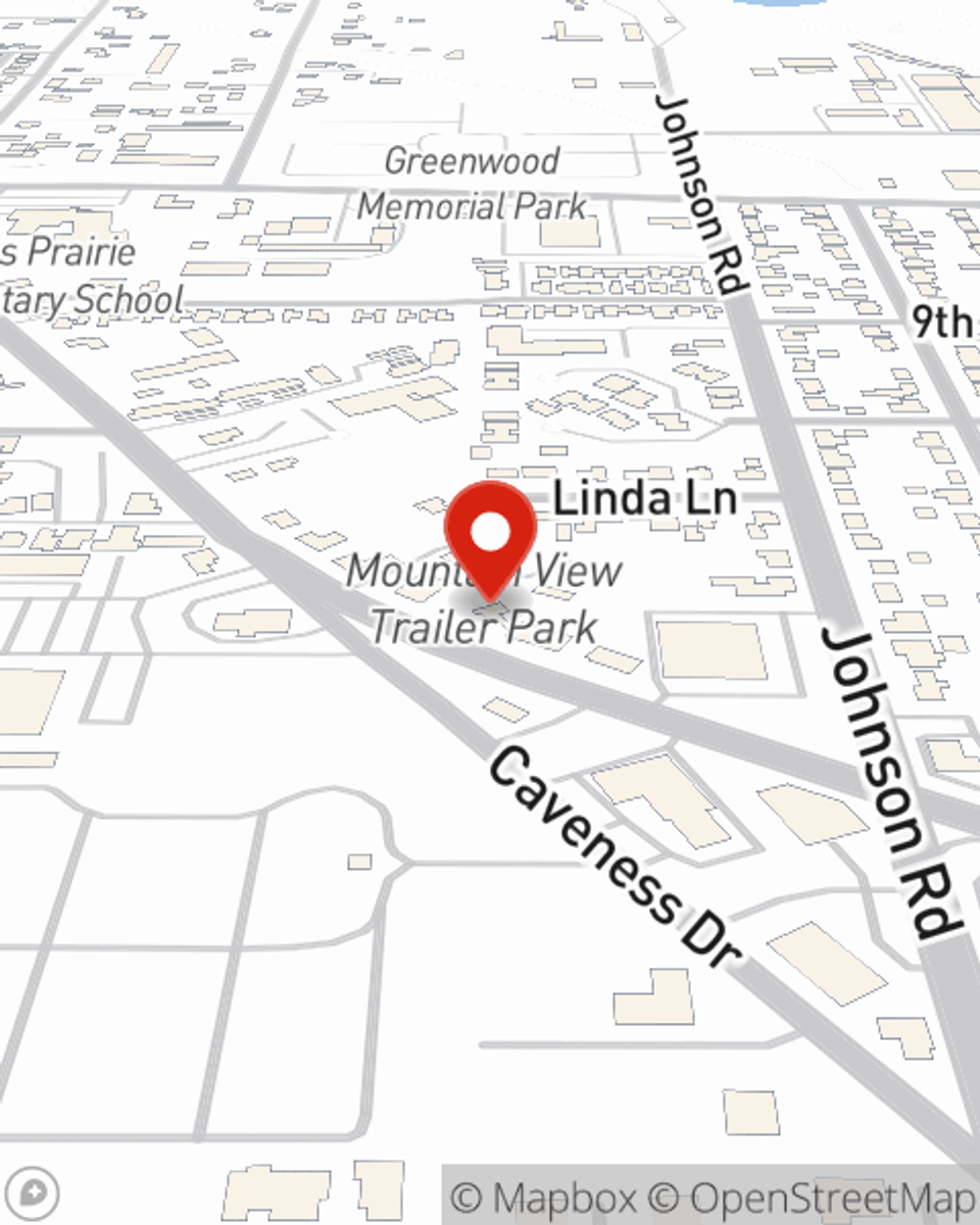

Ready to consider the business insurance options that may be right for you? Contact agent Bill Tufts's office to get started!

Simple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

Bill Tufts

State Farm® Insurance AgentSimple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.